Averaging Down: This is when an investor buys more of a stock as the price goes down. This makes it so your average purchase price decreases.

Bear Market: This is trading talk for the stock market being in a down trend, or a period of falling stock prices. This is the opposite of a bull market.

Beta: A measurement of the relationship between the price of a stock and the movement of the whole market. If stock A has a beta of 1.5, that means that for every 1 point move in the market, stock A moves 1.5 points and vice versa.

Blue Chip Stocks: These are the large, industry leading companies. They offer a stable record of significant dividend payments and have a reputation of sound fiscal management. The expression is thought to have been derived from blue gambling chips, which is the highest denomination of chips used in casinos.

Bull Market: This is when the stock market as a whole is in a prolonged period of increasing stock prices.

Broker: A person or a firm who buys or sells an investment for you in exchange for a fee (a commission).

Day Trading: The practice of buying and selling within the same trading day, before the close of the markets on that day. Traders that participate in day trading are often called “active traders” or “intraday traders.”

Dividend: this is a portion of a company’s earnings that is paid to shareholders, or people that own that company’s stock, on a quarterly or annual basis. Not all companies do this.

Exchange: An exchange is a place in which different investments are traded. The most known in India are BSE and NSE.

Execution: When an order to buy or sell has been completed. If you put in an order to sell 100 shares, this means that all 100 shares have been sold.

Hedge: This is used to limit your losses. You can do this by taking an offsetting position. For example, if you hold 100 shares of A, you could short the stock or futures positions on the stock.

Index: An index is a benchmark which is used as a reference marker for traders and portfolio managers. A 10% may sound good, but if the market index returned 12%, then you didn’t do very well since you could have just invested in an index fund and saved time by not trading frequently. Examples are Sensex and Nifty.

Initial Public Offering (IPO): The first sale or offering of a stock by a company to the public, rather than just being owned by private or inside investors.

Margin: A margin account lets a person borrow money (take out a loan essentially) from a broker to purchase an investment. The difference between the amount of the loan, and the price of the securities, is called the margin.

Moving Average: A stock’s average price-per-share during a specific period of time. Some time frames are 50, 100 and 200 day moving averages.

Order: An investor’s bid to buy or sell a certain amount of stocks. You have to put an order in to buy or sell 100 shares of stock.

Portfolio: A collection of investments owned by an investor. You can have as little as one stock in a portfolio to an infinite amount of stocks.

Quote: Information on a stock’s latest trading price. This is sometimes delayed by 20 minutes unless you are using an actual broker trading platform.

Rally: A rapid increase in the general price level of the market or of the price of a stock.

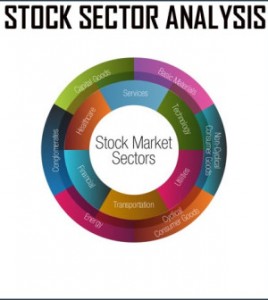

Sector: A group of stocks that are in the same business. An example would be the “Auto” sector including companies like Maruti Suzuki, Tata Motors and M&M.

Spread: This is the difference between the bid and the ask prices of a stock, or the amount someone is willing to buy it and someone is willing to sell it.

Stock Symbol: An alphabetic root symbol, which represents a publically traded company on a stock exchange. State Bank of India’s NSE stock symbol is SBIN.

Volatility: This refers to the price movements of a stock or the stock market as a whole. Highly volatile stocks are ones with extreme daily up and down movements and wide intraday trading ranges. This is often common with stocks that are thinly traded, or have low trading volumes.

Volume: The number of shares of stock traded during a particular time period, normally measured in average daily trading volume.

Yield: This usually refers to the measure of the return on an investment that is received from the payment of a dividend. This is determined by dividing the annual dividend amount by the price paid for the stock. If you bought a stock for Rs. 100-a-share and it pays a 3.00 Rs-per-year dividend, you have a “yield” of 3%