1) Just follow the trend and trading is easy

Being successful at trading isn’t as simple as following the direction (trend) of the market. The trend of the market is indeed critical.

Determining the trend of the market at any given moment is easy. Will the market continue to move in the direction of the trend after you buy in?

To evaluate that, you also need to know the momentum of the market (how strong the trend is), how early you’re getting into the trend (has everyone already bought in, or are there still a lot of market participants with their money on the sidelines who could join the trend?), whether it’s the right time to enter (cycles), whether you’re bouncing off a support level, and what the energy of momentum is on the higher scale.

Beyond all of that, trading still isn’t easy even if you have a successful trading methodology, because the hardest part of trading is your self-discipline.

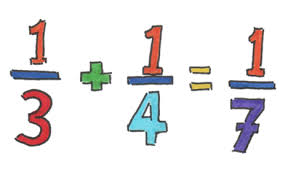

2) Just master 1 technical indicator

Trading is about developing a trading methodology that has enough variables that, when combined, provide a high-probability scenario that favors your profitability over a large sample of data.

No one single thing will make you money, especially not an indicator. Indicators do what they promise: They indicate. They can’t tell the future. They’re derivatives of price, volume, and/or other factors they measure, all put together in a mathematical format. That’s it. There’s nothing magical about them.

3) Brokerage is negligible

Like any business, trading has expenses. The more you can lower your expenses, the more net profit you can make. Some things are worth spending money on because they make you money. If you’re a day trader, for example, you want a fast computer and a fast Internet connection. Those are expenses that will make you money.

4) I have a gut feeling that market is headed

You don’t have a special intuitive connection with the market. No one does. At times, you may make money for a while and start to believe you’re special. That’s not an unusual experience, but it’s inevitably followed by a series of staggering losses.

5) You’d be profitable if you could find a trading method that worked

Many people have successful trading methods, and they don’t even know it. It may be because the method doesn’t fit their personality. It may be because they’re undisciplined and unfocused. It may be because they make too many mistakes, and they don’t bother to record them on their trade log and correct them.