Desire of Gold is deep rooted in human race. Generations have considered it as a precious metal and have used it vastly in jewelry, ornaments and medicines. Gold has also been a part of innovations in the electronics sphere. As gold is highly valued it has long been used for coinage, as bullion and for backing currencies.

What makes gold an investment option?

- Limited availability on earth.

Unlike Copper and Iron, Gold has comparatively fewer mines on earth and the cost of mining is also high. As per the World Gold Council, average industry cost of production is $1200 per ounce. Secondly, unlike silver it is not found while mining other metals.

- Longevity with no preservation cost

Gold can be stored for a very long period with no loss in weight. It does not rust due to unfriendly atmospheric conditions i.e. it doesn’t react with alkaline and acidic medium hence has high resistance to corrosion.

- Desirable metal

The glitter of gold is an attraction. History tells us about the fascination of civilizations towards gold ornaments. It is considered to be a precious metal and a symbol of wealth.

- Universal acceptance, hence substitutability

Since times immemorial, gold has existed and has been valued over other commodities. It became a satisfactory form of payment across societies. It was considered to imbibe discipline in the transaction system.

- More value in less weight

Each gram of gold has considerable value which makes it easier to carry and transport. One needs to carry less equivalent weight with gold compared to iron, copper and silver etc.

Partnership of Gold and Currency

Pondering over the history of gold and world currency, it is eminent that gold has been considered as a reliable backing to various currencies especially the ones that were powerful like Pound and US Dollar. In times of war, currency crisis or high inflation, the universal tendency has always been to hoard gold. This in turn has raised the value of the metal.

Let’s take a look at the long term returns associated with the metal:

Average price of gold in 1983: US $424 per troy ounce

Average price of gold in 2014: US $1,265 per troy ounce

This makes annual return at 3.59% approximately which is much lower than the returns expected in other investments.

However in countries like India, the returns on gold investment have been comparatively better.

Average price of gold in India in 1983: INR 1,800 per 10gms

Average price of gold in India in 2014: INR 30,000 per 10gms

This makes annual return at 9.50% approximately

This high return was owing to 2 reasons:

- Rupee has continuously depreciated vis-à-vis US dollar i.e. INR 31 per US dollar in 1983 to INR 62 per US dollar in 2014.

- Value to Gold has appreciated in terms of US dollars over the years.

But now as Indian rupee is stabilizing against dollar, we cannot expect much volatility in Indian currency which limits lucrative gains in future.

Has modern era made gold less valuable?

- Safe custody

Around 150 years ago, there used to be incidents like sinking ships carrying gold during wars or burying the metal under the ground. This lost gold use to make availability of metal rarer. But in modern era safe custody in the form of lockers etc. is present which makes sure that minimum gold is lost.

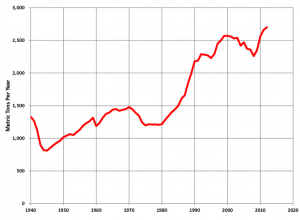

- Increasing annual production -> Increasing Supply

Source: Wikipedia

Annual production of gold is increasing as the production from existing mines is rising and there are new mines discovered (like Gold Mine found in Pakistan in Chiniot region in the territory of Punjab is assessed to be having at least 500 million tons of Gold). Countries like China, Australia, and Russia are in the forefront and few new names are also emerging in the list of top gold producing countries, such as Kazakhstan.

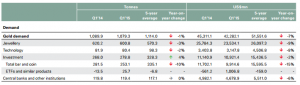

- Decreasing demand of gold

Source: Metals Focus; GFMS, Thomson Reuters; ICE Benchmark Administration; World Gold Council

New production is being added every year to the old stock but the proportional use of gold is decreasing. Use of this metal is primarily in jewelry, technology, medicine and financing & investing. This decline is making the precious metal less valuable.

- No interest gains on storage of gold

Money deposited/bonds fetch interest money from banks for the investor whereas gold doesn’t attract such benefits rather investor needs to pay charges to use the storage area.

Inferences

- Although gold has limited availability on earth but it is clear that its inherent characteristics (like inexhaustible and longevity) are increasing the net available stock every year. This is unlike other commodities like oil, grains etc. which get exhausted in one use and hence their supply remains a constraint always.

- Secondly there is no major currency crisis seen in the world today and the world is at peace. Hoarding gold is a safe option in times of economic upheavals as it safeguards value of wealth.

- In current scenario, as Indian rupee is stabilizing against US dollar and gold prices are not appreciating much in global market, we cannot expect major returns on gold investment for Indians like in past.

Conclusion

In the present scenario, although Central Banks must keep a gold reserve to back the paper currency but as far as general public is concerned investing in gold is a dead investment. Continuously increasing supply and decreasing demand of gold may pull down the price of gold in market. Good returns can only be expected if the rupee depreciates further w.r.t dollar and price of gold doesn’t depreciate in international market.