ATM Machine

ATM has made a life of common man very easy. Recently the government has given approval of 100% FDI for the White Label ATM. This is done to increase financial inclusion. You must be aware of word ATM, but White Label ATM what’s that? What you should know about White Label ATM. Well ATM machine is broadly classified in three categories

(1) White Label ATM (WLA)

(2) Brown Label ATM

(3) Bank own ATM

What is White Label ATM?

The Automated Teller Machines (ATMs) which is set up, owned and operated by non-banks is called as White Label ATM (WLA).

Features and Functions of White Label ATM are same as that of Normal ATM machines.

Difference is this ATM machine does not have any branding of Bank.

These machines are usually deployed by NBFC (Nonbanking Financial Institutions).

The basic idea about White Label ATM is to increase geographical spread of ATM so that more number of people can be incorporated under financial inclusion program.

What you should know about White Label ATM?

White Label ATMs are like normal ATM. However, cash deposit or cash acceptance facility is not permitted at the WLAs.

At White Label ATM you will not find logo of any bank like ICICI, SBI etc. You will find logo of White Label ATM operator on these ATMs.

An Individual can use their ATM-cum-debit cards, credit card for the cash withdrawal at these ATMs.

You can use WLA for cash withdrawal, utility bill payment, mini statement and PIN change.

In case of fail transaction while using white label ATM you need to report to card issuing bank. ATM card issuing bank is responsible of resolving conflict.

Cash Management at WLA will be done by sponsor bank. Sponsor bank will make an arrangement with NBFC for the cash at respective locations.

The Grievance Redressal Mechanism will be the same as that of normal bank ATMs.

How White Label ATMs Functions?

White Label ATMs are operated by NBFC. NBFC need a bank sponsor to settles all issues related to cash management, transaction settlement with other banks etc for this ATM. The sponsor bank has to tie up with the other bank at the place where it is not present.

What is Brown Label ATM?

Brown Label ATM is sharing cost concept. In Brown Label ATM hardware is owned by service provider, but cash management and network connectivity is provided by sponsor bank.

Features and functions of Brown Label ATM are same as that of normal ATM Machine.

This machine contains Logo of sponsor bank.

Brown Label ATM is cost effective solution for the banks.

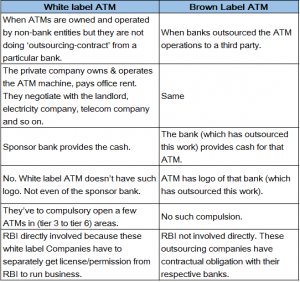

Difference White Label ATM, Brown Label ATM

What is Bank own ATM?

The Automated Teller Machines (ATMs) which is set up, owned and operated by banks is called as bank own ATMs. Responsibility of cash management, AMC, security lies with banks.